Get the business funds you need, on your terms.

Apply in 60 seconds, compare offers, and choose the best-fit financing option to grow your business.

Equipment Financing

Get the equipment your business needs without tying up cash flow. APPROVE connects you to lenders who specialize in equipment financing across industries.

- Up to $500K and 72 months

- Minimum $5K equipment value

- Start-ups possible

- No PG with > 9 years in business

- Same day funding

- Minimum closing costs

- No money down

Working Capital

Access funds to manage cash flow, cover expenses, or take on new opportunities. Our network of lenders provides flexible solutions to help your business stay strong and grow.

- Up to $400K and 24 months

- No collateral required

- Minimum 1 year in business

- Personal guarantee required

- Funding within 48 hours

- Minimum closing costs

- Renewable and paid to you

SBA 7(a) Loans

Secure long-term funding for major business investments like real estate or expansion. Our trusted SBA lenders offer competitive rates and flexible terms to support your growth.

- Up to $5M and 10 years

- Minimum 1 year in business

- Personal guarantee required

- Real estate must be owner occupied

- Longer payback terms

- Higher closing costs

- Lower rates

Fast financing in three simple steps.

Skip the endless forms and lender spam. Submit one application and choose from real offers tailored to your business. Not sure which option is right for you? We can help.

Step 1

Apply in 60 seconds.

Tell us about your business and what you’re looking to finance. One quick application connects you to our network of trusted lenders who specialize in helping businesses like yours.

- One simple, secure application

- No lender spam or repeated submissions

- Reviewed by real finance experts

Step 2

Review your offers.

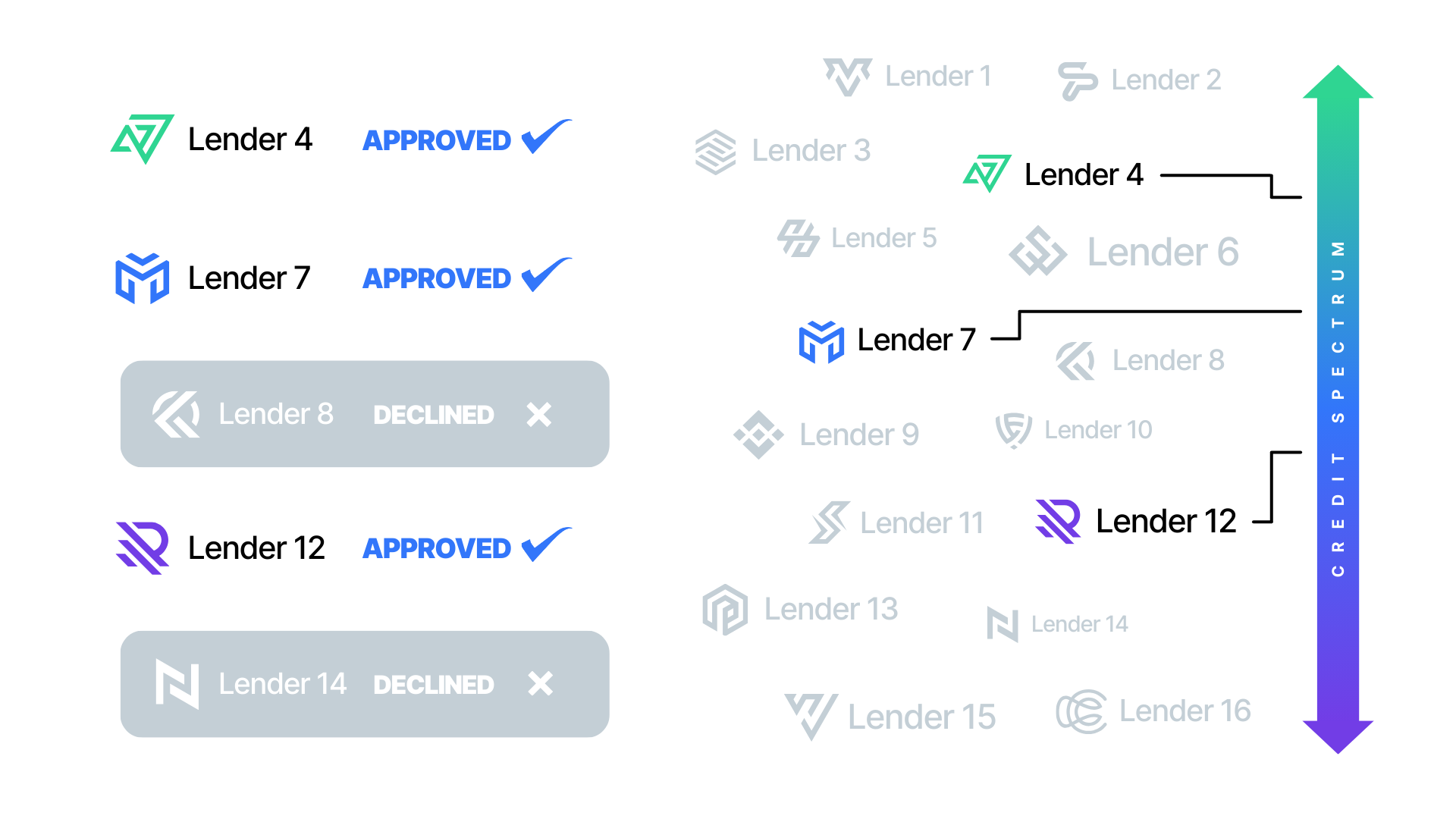

We instantly match your application with the lenders most likely to approve it, so you can compare competitive offers and choose the one that fits your goals.

- Compare up to three financing offers side-by-side

- Get expert help understanding each option

- Choose the best terms for your business

Step 3

Get funded fast.

Once you select your offer, your financing can be finalized quickly—helping you get the equipment or working capital you need to keep your business moving forward.

- See approvals in minutes and funding as early as the same day

- Get the equipment or capital you need without delay

- Turn your attention back to growing your business

Estimate your equipment financing power.

Our equipment financing calculator uses data from recently funded equipment deals to estimate your approval range, so you can plan your next purchase with confidence.

Finance as low as

Section 179 Tax Deduction Disclaimer

The equipment you purchase may qualify for a tax deduction

This is an estimate of net impact to the monthly payment after the Section 179 tax deduction. This deduction allows businesses to deduct the full purchase price of qualifying equipment or software in the year it is purchased, rather than depreciating it over several years.

This benefit can significantly reduce a business’s taxable income, providing immediate cash flow advantages. By enabling companies to deduct up to the annual limit set by the IRS, Section 179 encourages businesses to invest in new equipment, fostering growth, increased productivity, and enhanced profitability while also offering substantial tax savings.

Disclaimer: The after-tax rate we calculate is based on assumptions and general estimates. Actual tax outcomes may vary depending on individual circumstances, tax rates, and changes in tax laws. Always consult a tax professional for precise advice tailored to your situation.

Visit Section179.org for more information.

Grow your business with confidence.

"These guys went beyond the call of duty to help me purchase my machinery. Thank you very much A+."

Dennis D.

"Awesome service, very fast response and walked me through the whole process very fast and painless. Definitely will be doing more business in the near future."

Christopher S.

"These are some of my favorite people to work with. They are great with my customers!"

Jennifer C.

Frequently Asked Questions

How many lenders review my application?

APPROVE's large network of lenders is constantly growing, however, our technology matches your application with the lender(s) most likely to offer you the best rates based on your business type and credit profile. If more than one lender is a good fit for your business and credit profile, you may receive competing offers to compare.

How does this affect my credit?

There is no impact to your personal credit, unless a personal guarantee is required. Personal guarantees will have an inquiry on their credit by some lenders. Because these credit inquiries happen in a short timeframe, and for the same products, credit bureaus recognize them as part of a normal shopping process and will view them as a single credit inquiry by lenders.

How long does the application process take?

Can I finance equipment for personal use?

APPROVE does not provide equipment financing to consumers who wish to use the equipment only for personal use. Equipment financing is available to any business or organization that qualifies, including corporations, partnerships, LLCs, sole proprietorships and non-profits.

What is the average cost of financing?

The cost of financing can vary greatly depending on many different factors, including your business credit, industry, time-in-business and additional guarantees that may be pledged. Generally, equipment financing ranges from a 5% to 25% equivalent APR. That said, our approach to using a network of lenders assures you will achieve the lowest cost of financing possible.

Is equipment financing available outside of the United States?

Currently, equipment financing is only available to companies based in the United States and who intend to keep the equipment in the United States.

What is the minimum value of equipment I can finance?

The minimum value of equipment that can be financed is $1,500. On the other hand, there is no maximum amount and our lender network can offer competitive rates on equipment values into the millions.

GET STARTED

Power your business with smarter financing.

Tell us a little about your business, and we’ll connect you with the right expert to help you get started. Expect a quick, personalized follow-up with next steps tailored to your goals.