The complete financing platform for equipment sellers.

Offer financing everywhere you sell, connect buyers to multiple lenders instantly, and manage every deal from application to funding — all in one place.

Make financing an effortless part of your sales flow.

Give your customers the power to see affordable monthly payment options everywhere they shop — online, in person, or by quote — without changing how your team sells.

- Add financing to quotes and product pages

- Use QR codes and signage in-store

- Drop-in links for email and texts

- Works with the tools you already use

Seamless integrations for every point of sale.

E-Commerce

After a simple implementation, your website can become an E-Commerce powerhouse. APPROVE calculates and presents an estimated monthly finance payment next to every product.

A single click activates a pre-filled, itemized application slider right on the product page. Your customer can apply in about 60 seconds without ever leaving your site.

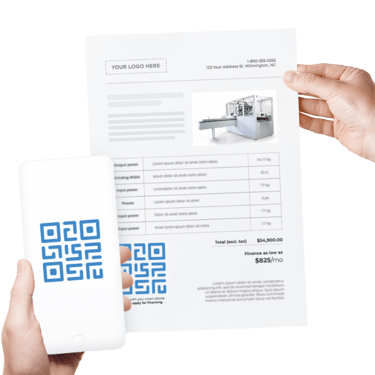

Quotes

Seeing the affordability of a low monthly payment option is often the deciding factor in buyer’s decision to move forward with an equipment purchase. APPROVE’s Finance My Quote integration technology enables you to embed estimated monthly finance payments and a digital finance application directly into your quotes...and it takes about 10 seconds!

-Feb-05-2026-01-59-19-7544-AM.png?width=456&height=380&name=Untitled%20design%20(6)-Feb-05-2026-01-59-19-7544-AM.png)

In-Store Signage

Whether it’s mobile tablets at your store counter tops or scannable QR codes on equipment and signage, APPROVE presents affordable monthly payments at your in-store points of sale and makes it easy for customers to apply in about a minute.

Product Spec Sheets

APPROVE’s Application QR code generator spits out a QR code associated with an itemized equipment finance application. Add the QR code to the appropriate product spec sheet and customers can scan and apply with their smart phones in about a minute.

Emails + Texts

APPROVE’s Application Link Generator enables users to create an itemized, web-hosted finance application in about 20 seconds and generate a hyperlink to the application that can be included in emails, texts, quotes or anywhere else you might paste a link.

Trade Shows

Many APPROVE customers place application QR codes on spec sheets, product signage and directly on equipment being showcased at industry trade shows. Booth visitors can apply on the spot in about 60 seconds with their smartphones.

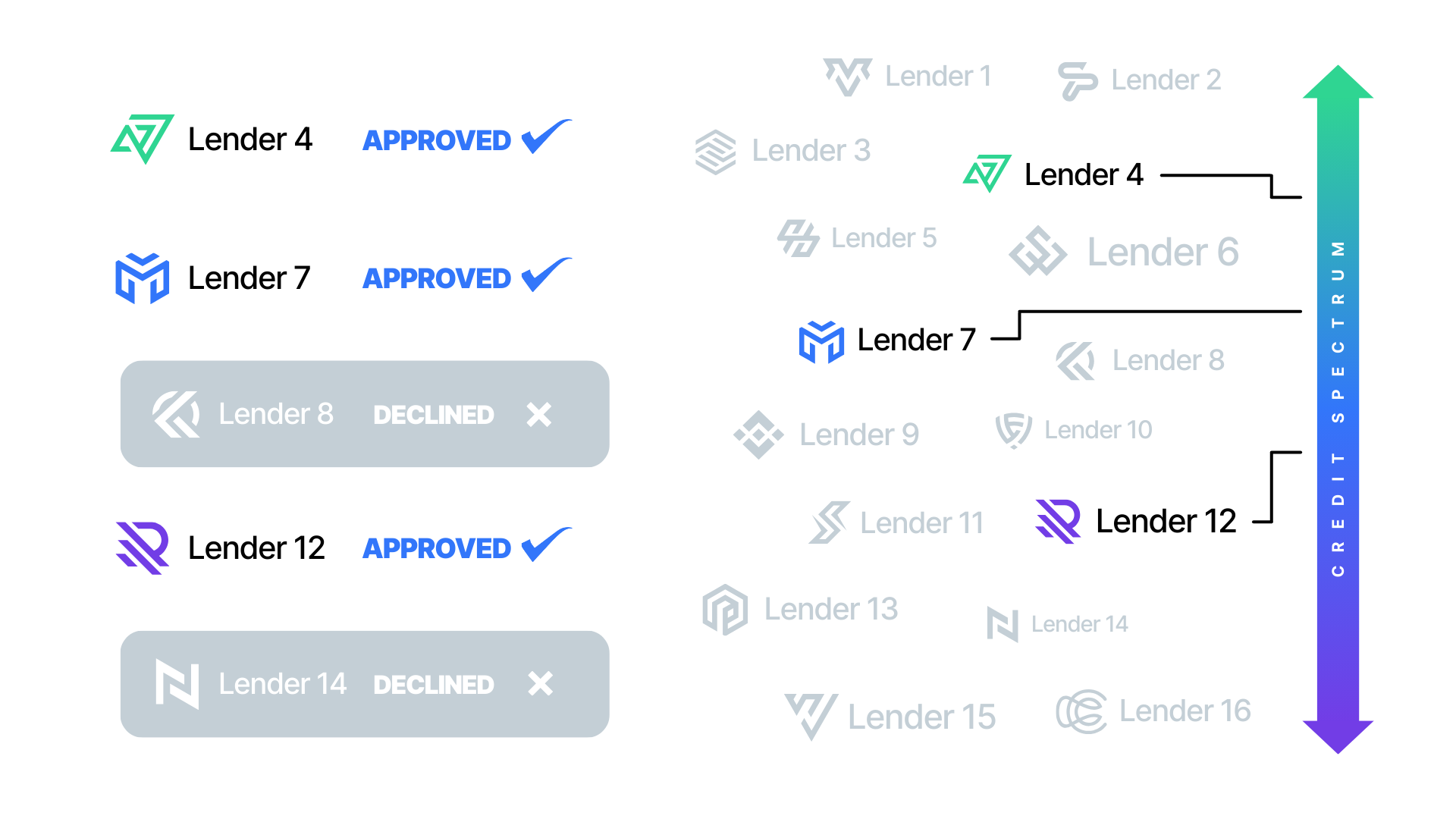

Get more approvals and close more deals.

One simple application instantly matches every buyer to their best-fit lender based on their business and credit profile. That means more customers get approved, deals move faster, and you spend less time on financing.

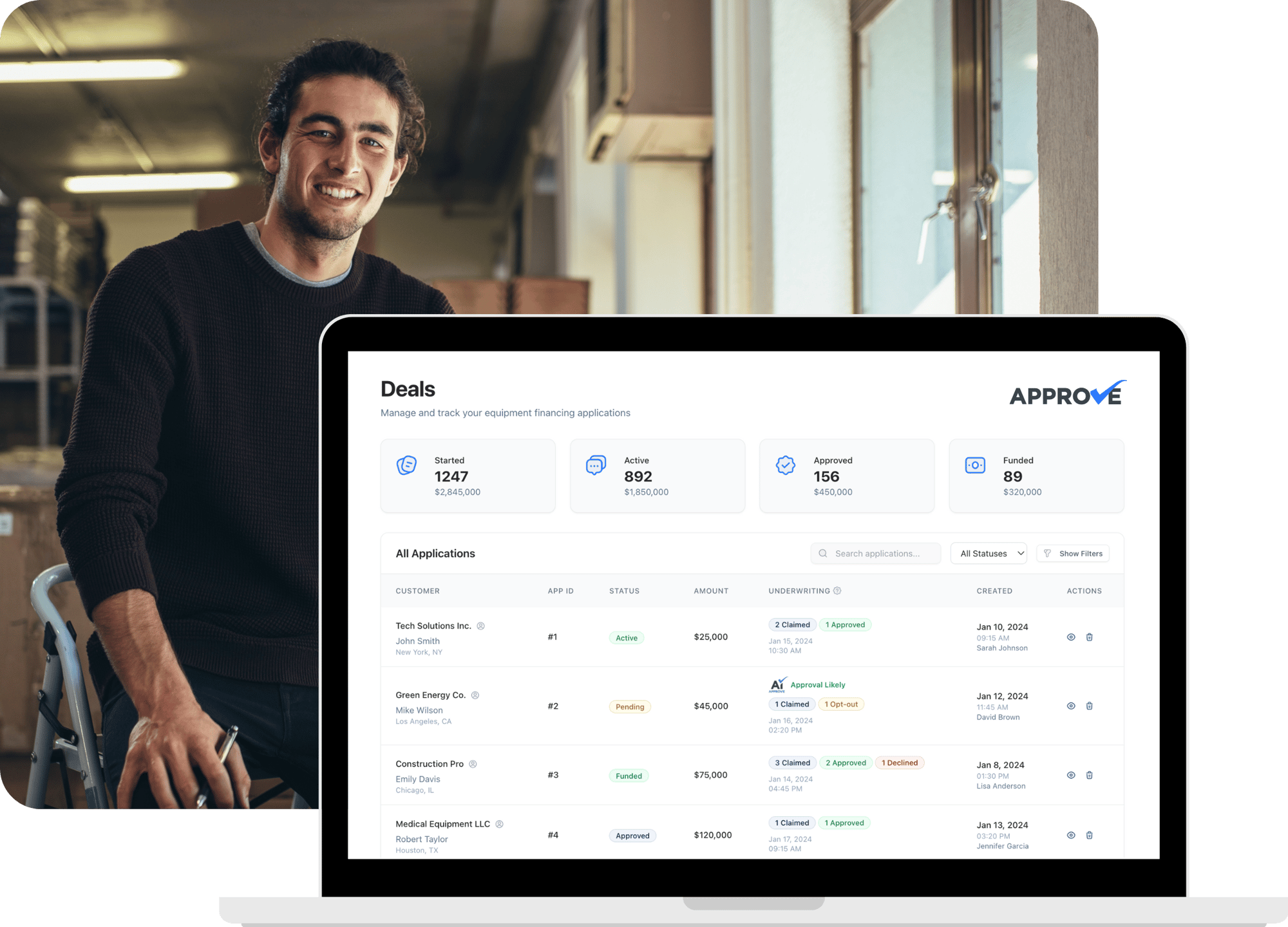

Track every finance deal from lead to funding.

Our easy-to-use dealer portal gives your team complete insight into every buyer’s journey. See who’s approved, who’s pending, and what’s needed to close the deal — all in one place.

- Centralized tracking for all applications

- Get notifications the moment offers are ready

- Focus your team’s time where it matters most

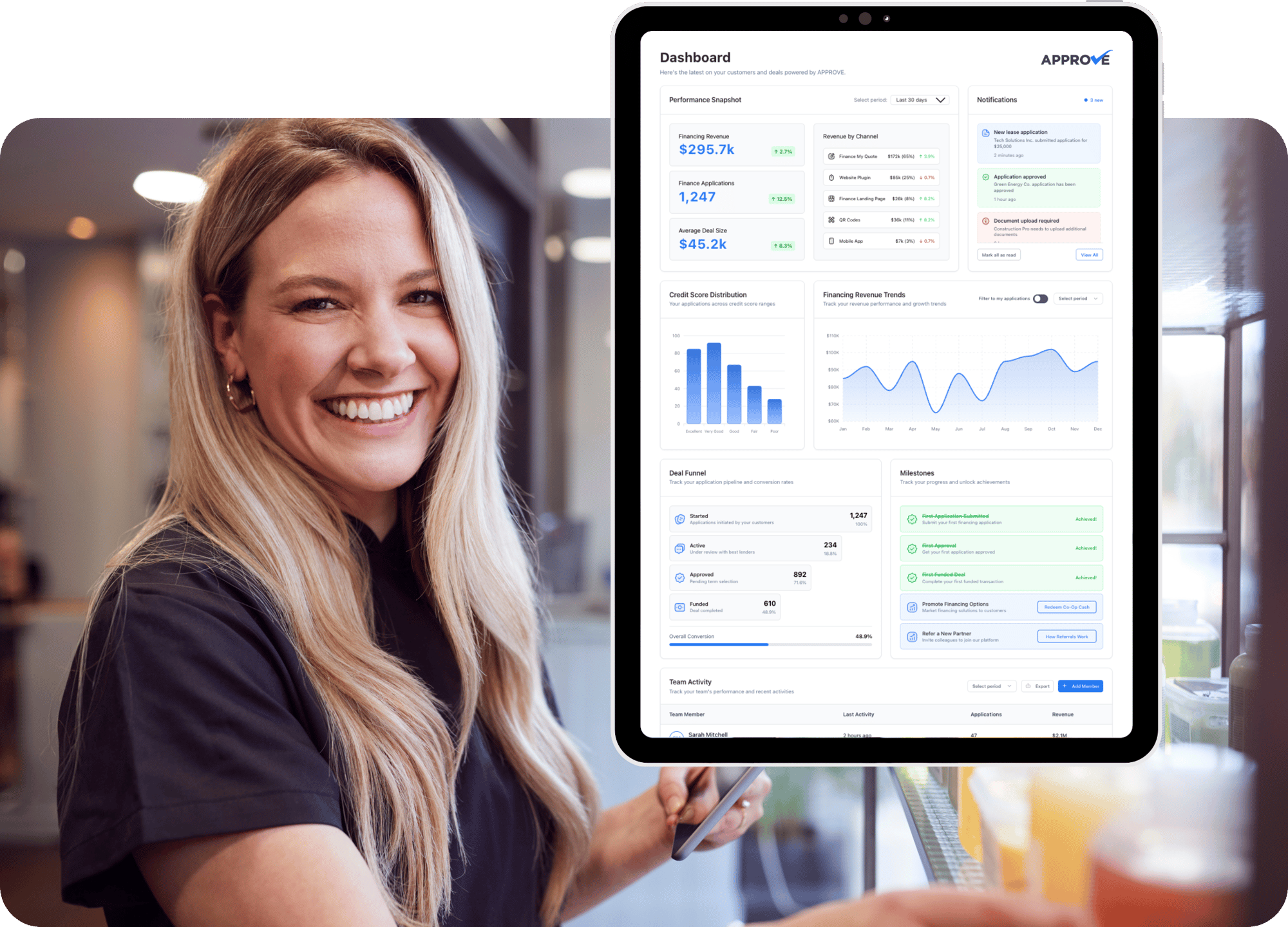

See how financing drives your sales growth.

Your vendor dashboard gives you a complete picture of how financing impacts your business. Track revenue generated through APPROVE, monitor team performance, and access resources to help your sales grow faster.

- Real-time revenue insights

- Sales and marketing enablement resources

- Knowledge base with product guides

- Track individual sales team activity

- View deal funnel at a glance

Stay in the loop with our expert finance team.

Technology drives speed, but people drive success. Every APPROVE partner gets a dedicated finance team that works directly with your buyers and lenders to keep deals moving smoothly.

We handle approvals, answer questions, and manage lender communication — so your team can stay focused on selling.

Increased Revenue

Offer flexible financing options that make equipment more affordable and boost your average order value.

Marketing Support

Access ready-to-use templates, signage, and digital assets that help you promote financing.

Trusted Expertise

Our financing specialists work alongside your team to guide buyers and keep deals on track.

No Cost To You

APPROVE is free for suppliers, with lenders covering brokerage fees. You get the benefit without the expense.

How it works

From application to funded deal, here’s how APPROVE makes it happen.

Buyer Submits Application

Instant Lender Matching

Buyer Chooses Best Option

Deal Funds and You Get Paid

"These guys went beyond the call of duty to help me purchase my machinery. Thank you very much A+."

Dennis D.

"Awesome service, very fast response and walked me through the whole process very fast and painless. Definitely will be doing more business in the near future."

Christopher S.

"These are some of my favorite people to work with. They are great with my customers!"

Jennifer C.

Frequently Asked Questions

How does the equipment financing program work?

In order to offer our customers the best financing options available, we've implemented APPROVE financing technology. APPROVE makes it easy to receive and compare multiple financing offers from a network of the nation's top equipment finance companies. Here's how it works:

Step 1: Complete your application

Once you receive an equipment quote from your US Foods representative, applying for financing is easy. Simply visit our online finance application at www.usfoods.com/getapproved. From there you can enter the Job Reference # and Total Quote Amount from your US Foods equipment quote as well as your US Foods Rep's name to receive an estimated monthly payment amount and complete a simple application for financing.

Once submitted, your application is sent to the APPROVE Lender Network where the first three lenders to claim your application are given the opportunity to review and approve it.

Step 2: Review your approvals

Each time a lender approves your application, you'll receive an email with a link to review their finance offer. You may receive up to three competing offers and can easily compare them side-by-side.

Please Note: Some lenders may ask you for information that was not requested on the initial application. Providing this information maximizes your chances for approval and ensures you're getting the best rates available.

Step 3: Select your offer and sign your finance agreement

Click the link on any of the approval emails you received to open and review your offers side-by-side. When you're ready, choose the lender offer that best suits your business' needs. Your selected lender will send documents for your signature. Sign the docs to complete the finance process.

What is the advantage of working with a network of lenders?

- The highest chances for application approval

- The best rates available

- Faster turnaround times

Are applicants obligated to move forward if the application is approved?

No. Applicants have the opportunity to accept or decline any or all offers that are presented to you by participating APPROVE lenders.

How many applications are approved?

Each lender in the APPROVE network has its own criteria for determining which applications will be approved. Using a network of lenders enables approvals for a wider range of business and credit profiles.

However, generally speaking, in the current economic environment, most lenders require:

-

At least 2 years in business

-

If less than 3 years in business, a personal guarantee from an owner with at least 51% ownership of the business and a minimum personal FICO score of 650

-

Proof that revenue is currently being generated by the business

How long does it take?

The timing can vary. It is not uncommon to receive approvals in a matter of hours. The occasional delays are typically due to a lender's need for additional business information, so be on the lookout for these types of requests. As long as you provide the requested details promptly, approval decisions happen very quickly.

Is equipment financing available outside of the United States?

Currently, equipment financing is only available to companies based in the United States and who intend to keep the equipment in the United States.

GET STARTED

Power your business with smarter financing.

Tell us a little about your business, and we’ll connect you with the right expert to help you get started. Expect a quick, personalized follow-up with next steps tailored to your goals.