Unlock Extra Sales with Flex Approvals

When buyers receive multiple offers through APPROVE's lender network, any unused approvals can remain active and create additional sales opportunities.

Turn Financing Approvals into More Sales

At APPROVE, we work with a nationwide network of lenders to match each buyer with the financing partner best suited for their business and application. In many cases, our lenders go a step further: Even if a buyer chooses to fund their original purchase with a different lender, some lenders will honor their approval through its expiration date. We call these approvals Flex Approvals, and they create powerful opportunities for your sales team.

What is a Flex Approval?

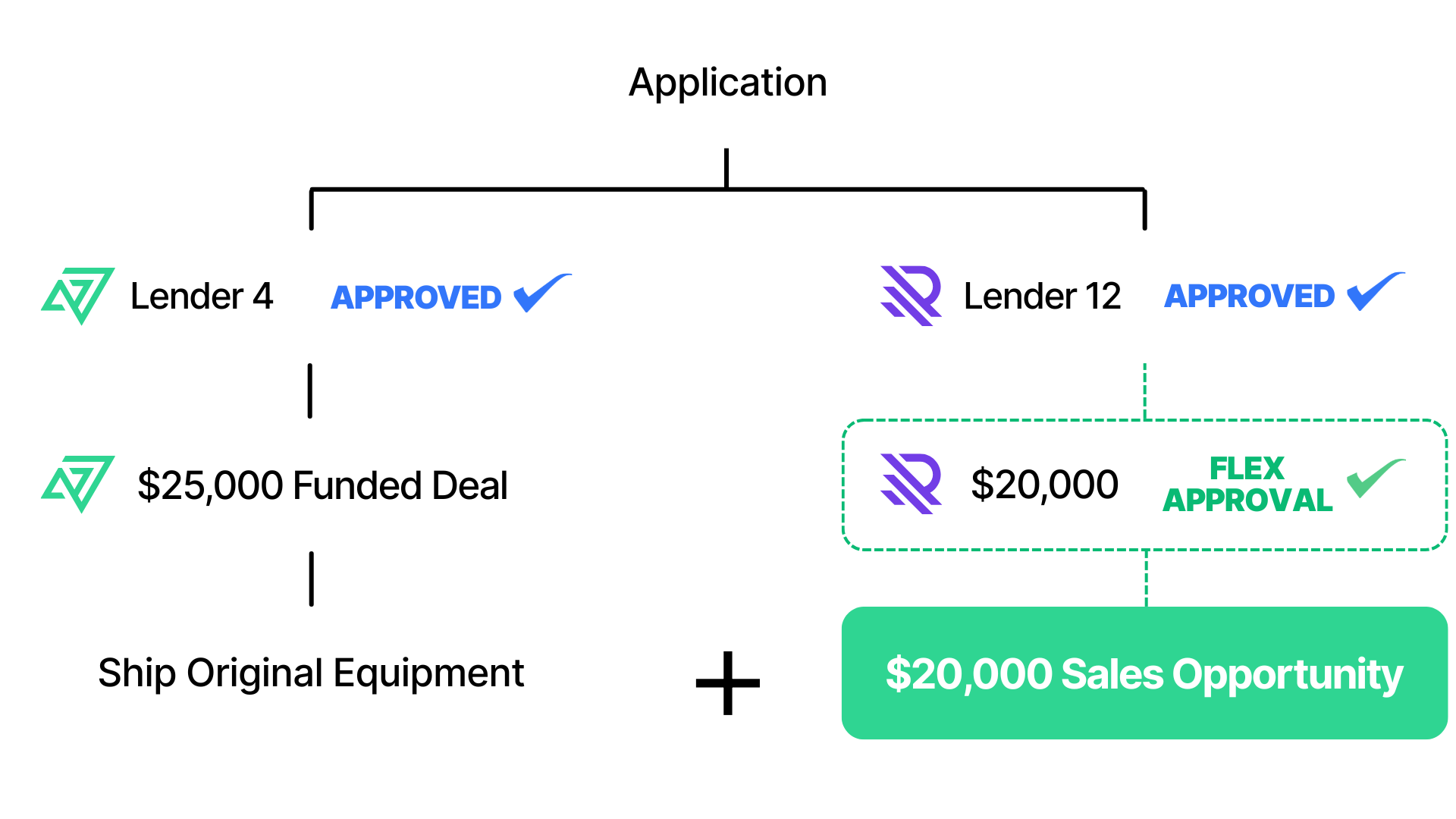

A Flex Approval is a lender-issued financing approval that remains valid even if the buyer funds their initial transaction with another lender.

That means a buyer may receive multiple approvals for a single application, choose to fund with Lender A, and still retain an active approval from Lender B.

This remaining approval becomes flexible buying power that can be used to finance additional units of the same equipment or different equipment.

In short: your buyer may still have financing available, even after they’ve already bought from you.

Why Flex Approvals Matter for You

How Flex Approvals Work

-

Buyer applies for financing through APPROVE

-

-

Multiple lenders review the application

-

-

The buyer may receive several approvals

-

-

The buyer chooses a lender and completes the initial purchase

-

-

Other lenders may keep their approval active until its expiration date

-

-

APPROVE notifies you when a buyer has a valid Flex Approval so you can follow up with confidence

Use Flex Approvals to Drive Additional Revenue

APPROVE is committed to helping you increase sales by identifying opportunities that often go unnoticed. Flex Approvals provide a new, data-driven way to unlock incremental revenue and strengthen customer relationships.

When your buyer gets extra buying power, you should be the first to know, and the first to reach out.