Industrial Equipment Financing

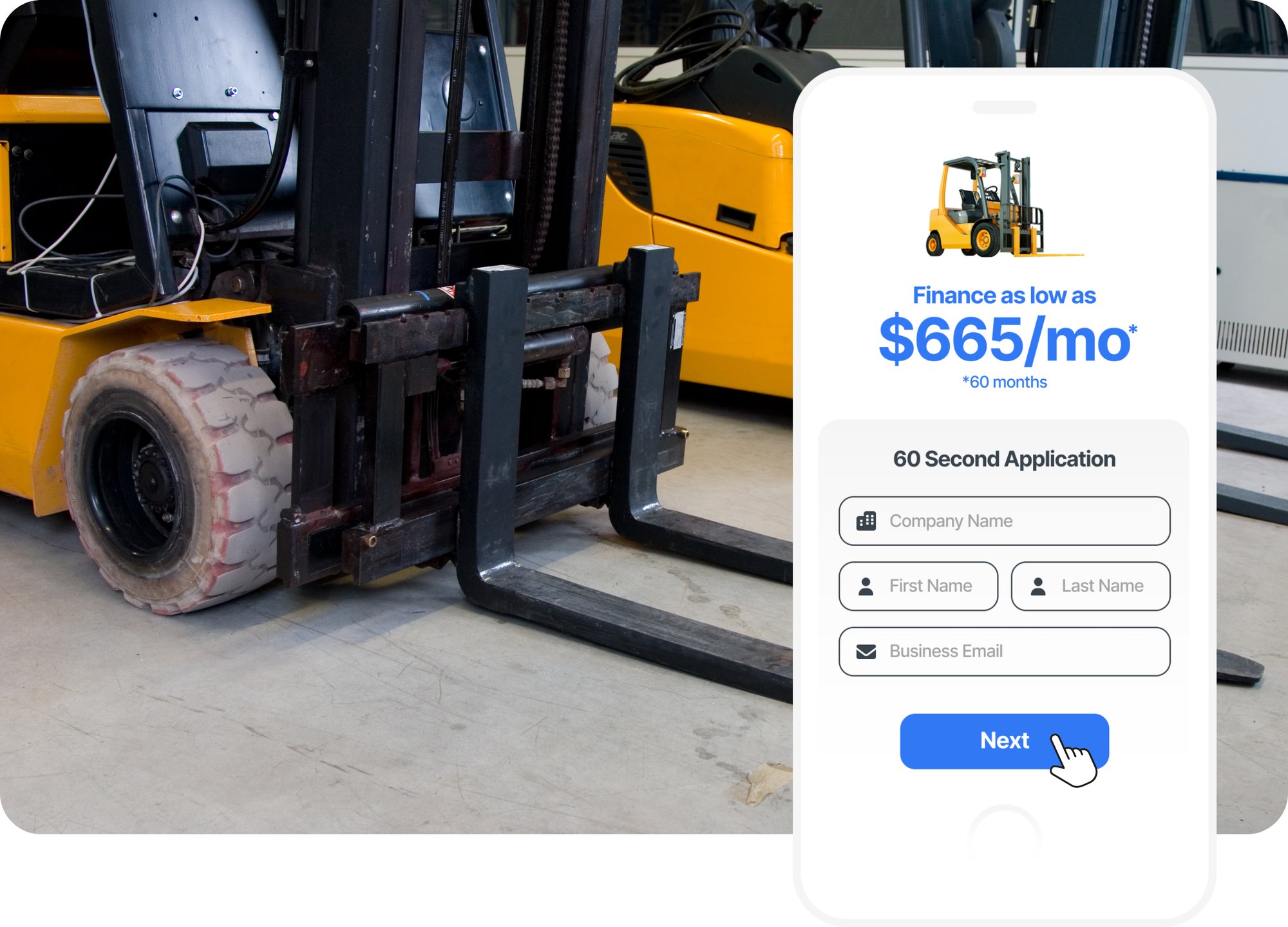

Apply in 60 seconds, compare offers, and choose the best-fit financing option to grow your business.

Are you an equipment seller looking for finance solutions? Click here.

Get the industrial equipment you need, on your terms.

With one quick application, buyers are instantly matched to our powerful network of lenders competing to offer their best terms. Whether you need new or used equipment like forklifts, telehandlers, or scissor lifts, we help you secure the right financing option.

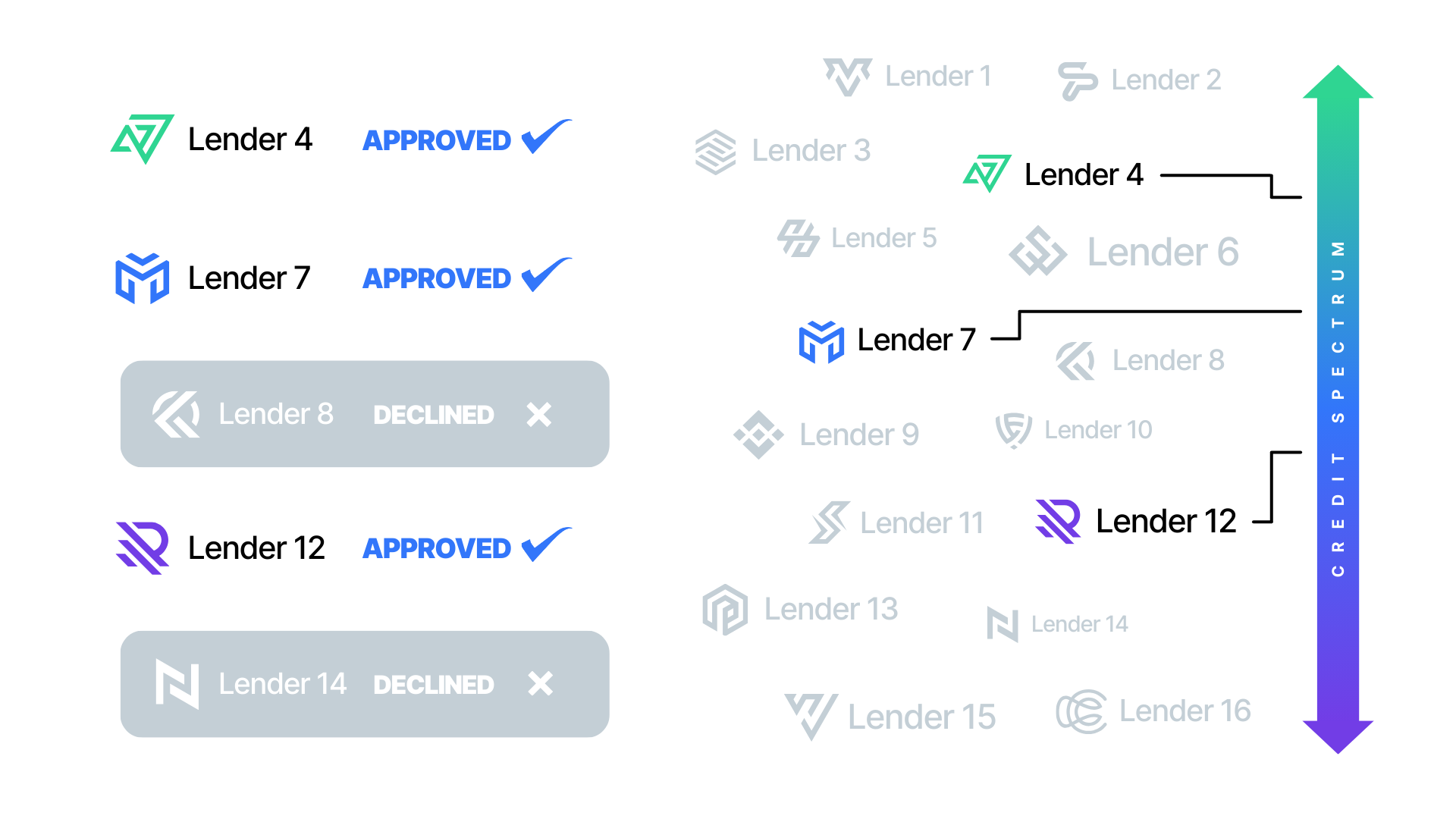

Smart lender matching means better approval chances.

Instead of guessing which lender might say yes, we do the work for you. Your application is routed to lenders that fit your business and equipment needs—helping you secure competitive terms quickly so you can stay focused on running your operation.

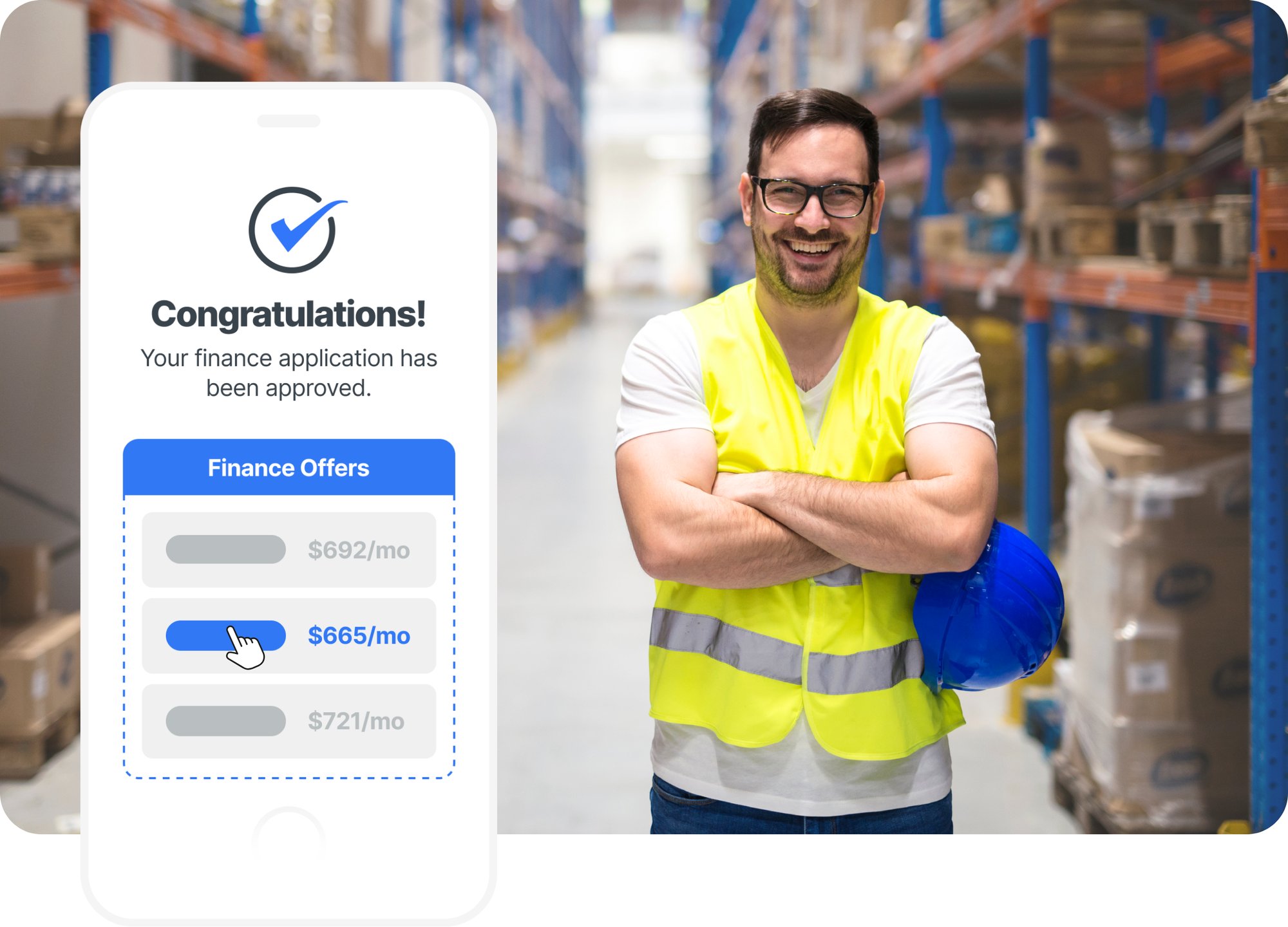

Choose the financing offer that works best for your business.

We make it easy to compare your best options side by side so you can move forward with confidence. See offers from lenders competing for your business, review monthly payments and terms, and choose the financing that fits your goals.

- Compare up to three personalized offers

- Review payment terms clearly before deciding

- Get your equipment fast

Take the easy path to approval.

From application to funded deal, here’s how APPROVE makes it happen.

Apply in 60 Seconds

Match with Lenders

Choose the Best Option

Get Your Equipment

Preserve Cash Flow

Shift big equipment costs to affordable monthly payments and keep your capital free for growth.

Lower Upfront Costs

Get started with minimal out-of-pocket expense compared to traditional bank loans.

Build Business Credit

Strengthen your company’s credit profile by financing under the business, not personal lines.

Maximize Tax Savings

Use Section 179 and other tax advantages to reduce your total cost of ownership.

Estimate your equipment financing power.

Our equipment financing calculator uses data from recently funded equipment deals to estimate your approval range, so you can plan your next purchase with confidence.

Finance as low as

Section 179 Tax Deduction Disclaimer

The equipment you purchase may qualify for a tax deduction

This is an estimate of net impact to the monthly payment after the Section 179 tax deduction. This deduction allows businesses to deduct the full purchase price of qualifying equipment or software in the year it is purchased, rather than depreciating it over several years.

This benefit can significantly reduce a business’s taxable income, providing immediate cash flow advantages. By enabling companies to deduct up to the annual limit set by the IRS, Section 179 encourages businesses to invest in new equipment, fostering growth, increased productivity, and enhanced profitability while also offering substantial tax savings.

Disclaimer: The after-tax rate we calculate is based on assumptions and general estimates. Actual tax outcomes may vary depending on individual circumstances, tax rates, and changes in tax laws. Always consult a tax professional for precise advice tailored to your situation.

Visit Section179.org for more information.

Finance a wide range of industrial equipment with ease.

- Forklifts

- IC forklifts

- Reach trucks

- Order pickers

- Pallet jacks

- Rider jacks

- Stackers

- VNA forklifts

- Side loaders

- Telehandlers

- Rough terrain lifts

- Tow tractors

- Pallet trucks

- Platform carts

- Hand trucks

- Drum handlers

- Coil lifters

- Guided vehicles

- Mobile robots

- Robotic palletizers

- Pallet shuttles

- Storage systems

- Case packers

- Pick-to-light

- Sorter systems

- Conveyors

- Overhead cranes

- Bridge cranes

- Jib cranes

- Hoists

- Monorail systems

- Pallet racks

- Drive-in racks

- Push-back racks

- Cantilever racks

- Flow racks

- Carton racks

- Mezzanines

- Mobile shelving

- Lift modules

- Scissor lifts

- Lift tables

- Dock levelers

- Dock lifts

- Yard ramps

- Stretch wrappers

- Strap machines

- Battery systems

"These guys went beyond the call of duty to help me purchase my machinery. Thank you very much A+."

Dennis D.

"Awesome service, very fast response and walked me through the whole process very fast and painless. Definitely will be doing more business in the near future."

Christopher S.

"These are some of my favorite people to work with. They are great with my customers!"

Jennifer C.

GET STARTED

Power your business with smarter financing.

Tell us a little about your business, and we’ll connect you with the right expert to help you get started. Expect a quick, personalized follow-up with next steps tailored to your goals.