Now is a Great Time to Introduce Equipment Buyers to APPROVE’s Lender Network

The recent collapse of multiple banks—most notably Silicon Valley Bank and Signature Bank—is making it harder for many small businesses to get the financing they need to purchase new equipment. This is an important moment for equipment sellers to be able to connect buyers with more efficient and available financing solutions.

APPROVE is an embedded finance solution that enables equipment sellers to offer customers a fast, easy financing process. APPROVE gives buyers access to a curated network of lenders—making it more likely that deals will get approved without the hassle of querying multiple lenders individually.

Why This Matters Now

Recent interest rate hikes by the Federal Reserve had already created a tight financing environment for small businesses. But in the wake of the March bank failures, many lenders tightened their standards for business loans. This was especially true for smaller banks—a source of credit that is particularly important to small businesses.

A recent analysis by Goldman Sachs notes that at least 70% of small-business lending is done by smaller banks, and these banks are likely to tighten lending more drastically than larger banks. Goldman’s researchers noted that the service and construction sectors—both of which often rely on equipment to grow their businesses—have the largest concentration of small businesses.

And larger banks aren’t necessarily going to fill the credit gap. The Biz2Credit Small Business Lending Index showed that small-business loan approval rates at big banks fell from 14.2% in February to 13.8% in March—the lowest approval rate since July 2021.

Media outlets increasingly feature small to medium-sized businesses that are struggling to get the financing they need to buy new equipment. NPR reported on a Houston-based construction company that can’t get a loan to purchase a new Bobcat tractor and IMER mixing machine. The Associated Press reported on a cider maker who couldn’t get funding to expand his business by building a taproom.

There’s a Better Way

Equipment financing doesn’t have to be this hard. If you sell equipment, you can provide an important service that will build your customer relationships by connecting your buyers with the power of tech-enabled embedded financing through APPROVE.

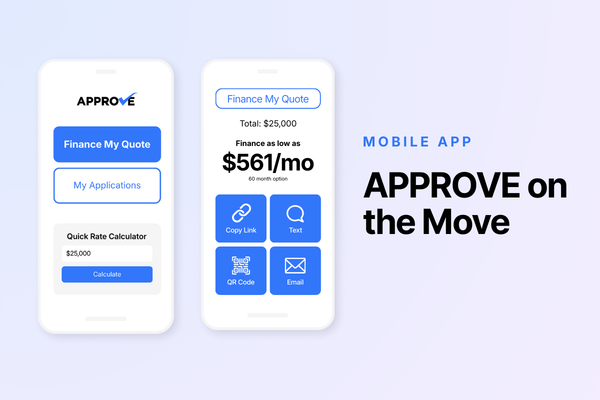

APPROVE gives you the power to instantly connect customers with financing applications and quotes. Tools such as our App Link Generator and new Add-an-App feature make this easy to do via email or text. In person, our QR codes put financing information in front of your customer from the showroom floor.

These tools connect your customers with APPROVE’s vast network of lenders. This carefully curated network includes specialty lenders that span industries and can cover various categories of credit.

To optimize this dynamic lender network, APPROVE has built machine-learning technology that matches applications with the lenders most likely to offer the lowest financing cost and most favorable terms. This unique machine-learning capability observes and tracks lenders in APPROVE’s network in real-time to constantly update and approve the algorithm.

The Bottom Line: More Sales

APPROVE’s internal research shows that early engagement and speed of delivery of finance application approvals are the two most important factors in increasing conversions. Our network provides a ready pool of lenders, and our technology removes a lot of the time-consuming manual work that would normally go into pursuing multiple lenders.

As the world of B2B sales becomes increasingly digital, this type of service will become essential for equipment sellers to offer. APPROVE can help you stay ahead of the trend, and the current tight credit environment is an opportunity to provide added value by connecting your customers with a more efficient financing experience.

Ready to get started? Contact us.