Smart equipment financing for every point of sale.

Instantly match every equipment buyer to our powerful network of lenders to maximize approvals and close more deals, faster.

Built by equipment sellers, for equipment sellers.

We started as an online equipment marketplace and saw firsthand how financing could slow everything down. Instead of waiting for someone else to fix it, we set out to create a better solution ourselves. Now we help buyers and sellers everywhere grow their businesses with a financing process that finally works. Read our story.

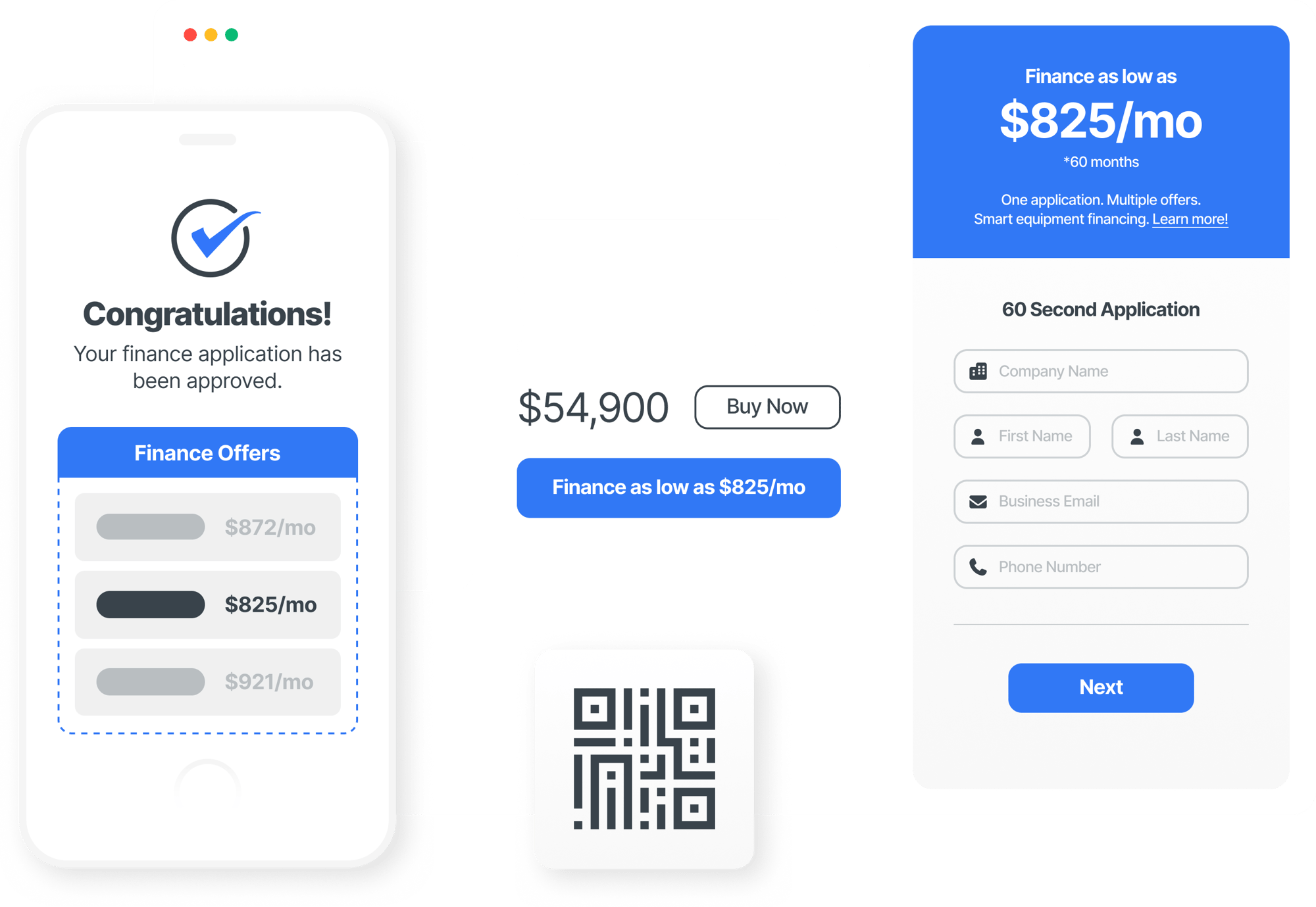

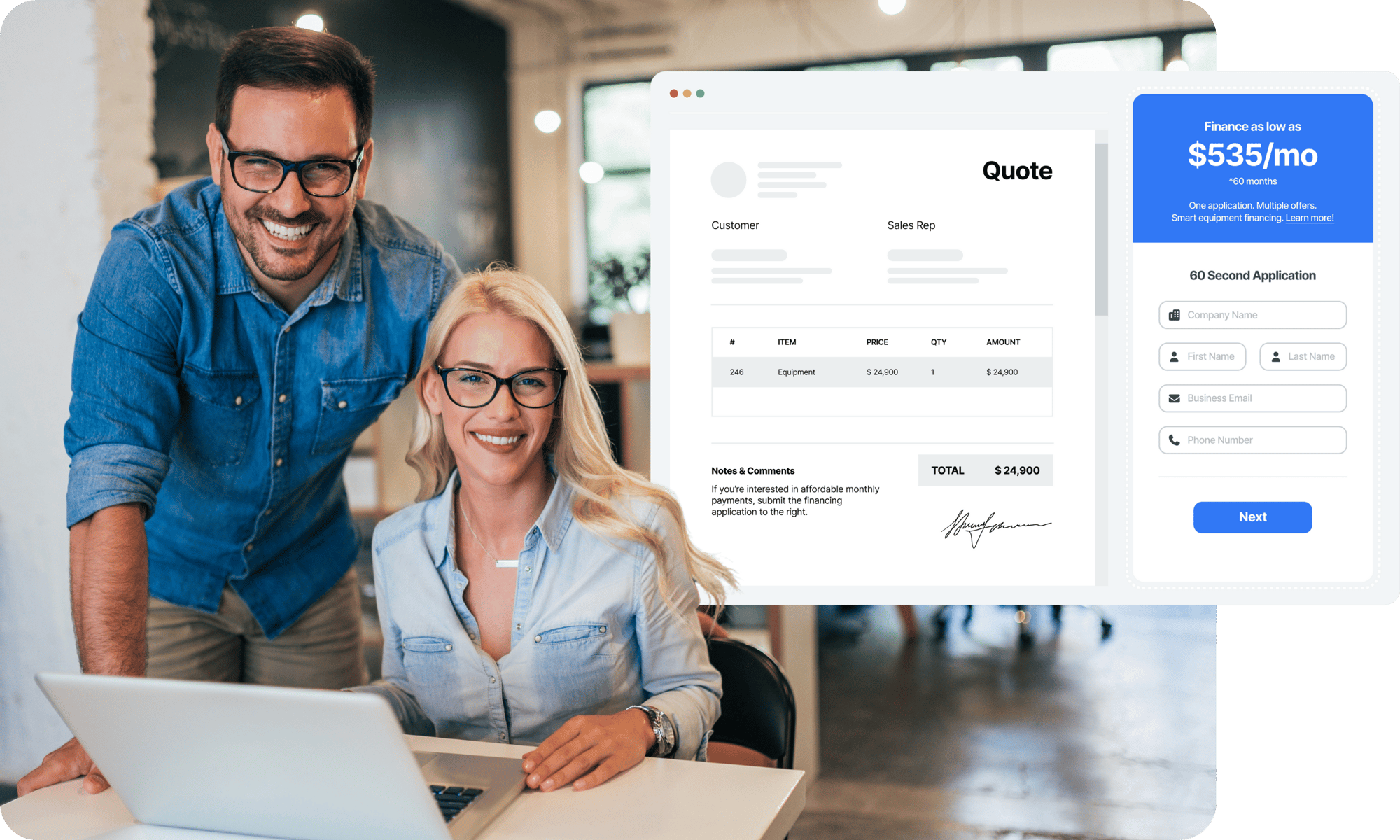

Show affordable payment options everywhere.

APPROVE integrates seamlessly to make affordable monthly payment options visible everywhere buyers make decisions.

- Embed financing directly into quotes and product pages

- Add QR codes and signage to retail or event displays

- Include financing links in email, text, or digital campaigns

- Works with your existing tools and workflows

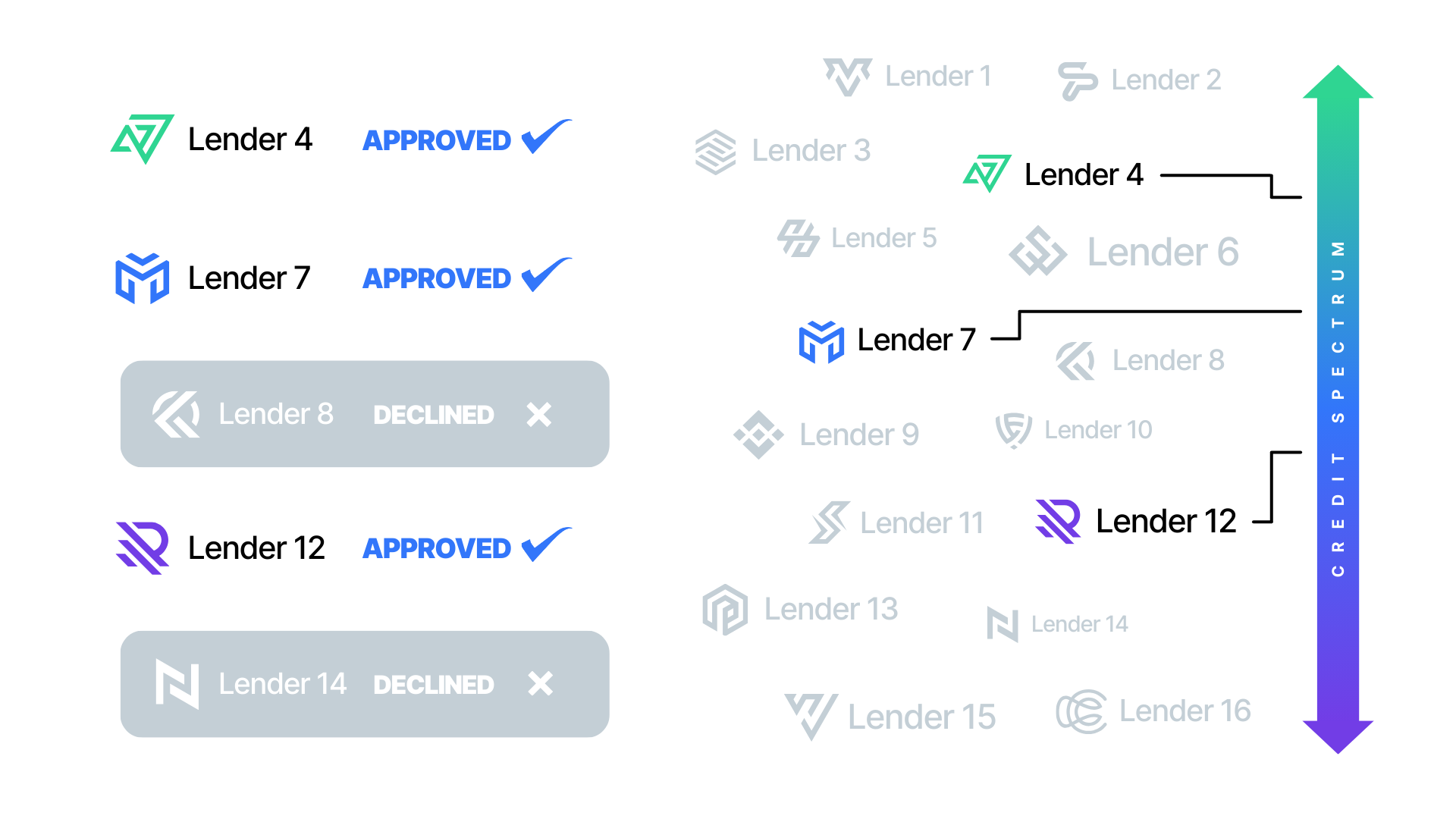

Get more approvals across the credit spectrum.

One simple application instantly matches every buyer to their best-fit lender based on their business and credit profile. That means more customers see approvals and your team spends less time chasing paperwork.

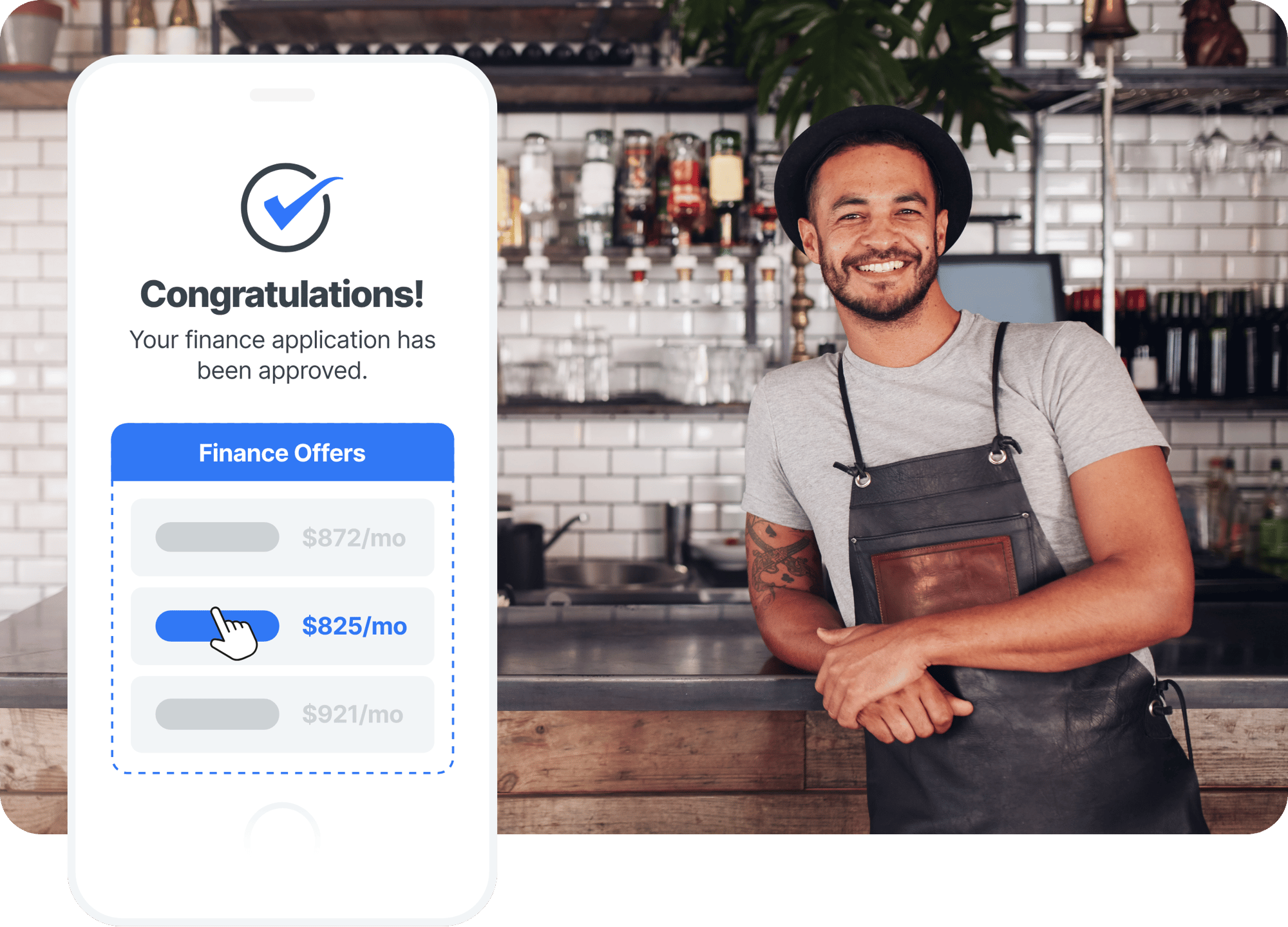

Win more deals with competing offers.

When buyers see the best financing options available, they feel confident making the right decision for their business.

- Show up to 3 approvals from competing lenders

- Present clear term options side by side

- Help buyers make informed business choices

- Keep deals from slipping away at the point of decision

79% of equipment buyers are looking for financing.

We help dealers capture and win those deals.

Our Process

Give your sales team an edge with a financing process that’s proven to drive more approvals and bigger deals.

%20copy%202.png?width=960&height=1200&name=Untitled%20design%20(1)%20copy%202.png)

Success Stories

APPROVE is driving significant sales growth for equipment dealers, but don’t take our word for it! Check out what our customers are saying.

"A lot of finance companies make bold claims about their technology and their ability approve more applications, but APPROVE is the only one that we’ve experienced executing on that promise."

Austin Ervin, Sales and Marketing Director

Southeastern Equipment & Supply, Inc

Top Industries We Serve

Everywhere business equipment is sold, we make financing faster, easier, and more effective. Learn more about how we help your industry.

GET STARTED

Power your business with smarter financing.

Tell us a little about your business, and we’ll connect you with the right expert to help you get started. Expect a quick, personalized follow-up with next steps tailored to your goals.