The only equipment financing

platform you'll ever need.

Offer your customers a custom branded finance program,

embedded at every point of sale.

%201.png?width=2000&height=1595&name=header-image%20(1)%201.png)

Make financing an effortless part of your sales flow.

APPROVE makes financing visible at every touchpoint without disrupting your current sales process.

- Add financing to quotes and product pages

- Use QR codes and signage in-store

- Drop-in links for email and texts

- Works with the tools you already use

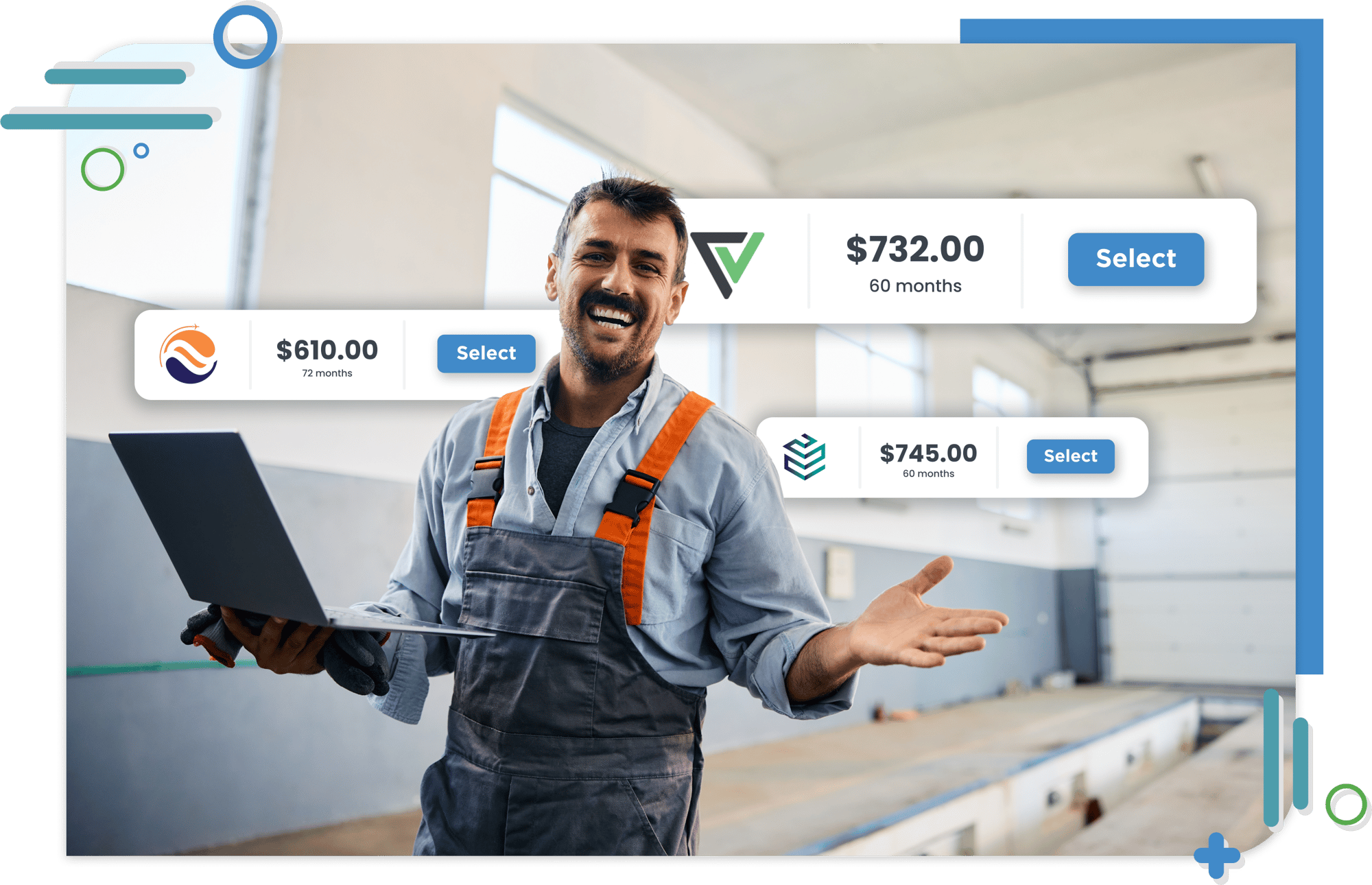

Match every buyer to their best-fit lender.

One simple application instantly matches every buyer to their best-fit lender based on their business and credit profile. That means more customers get approved, deals move faster, and your team spends less time on financing.

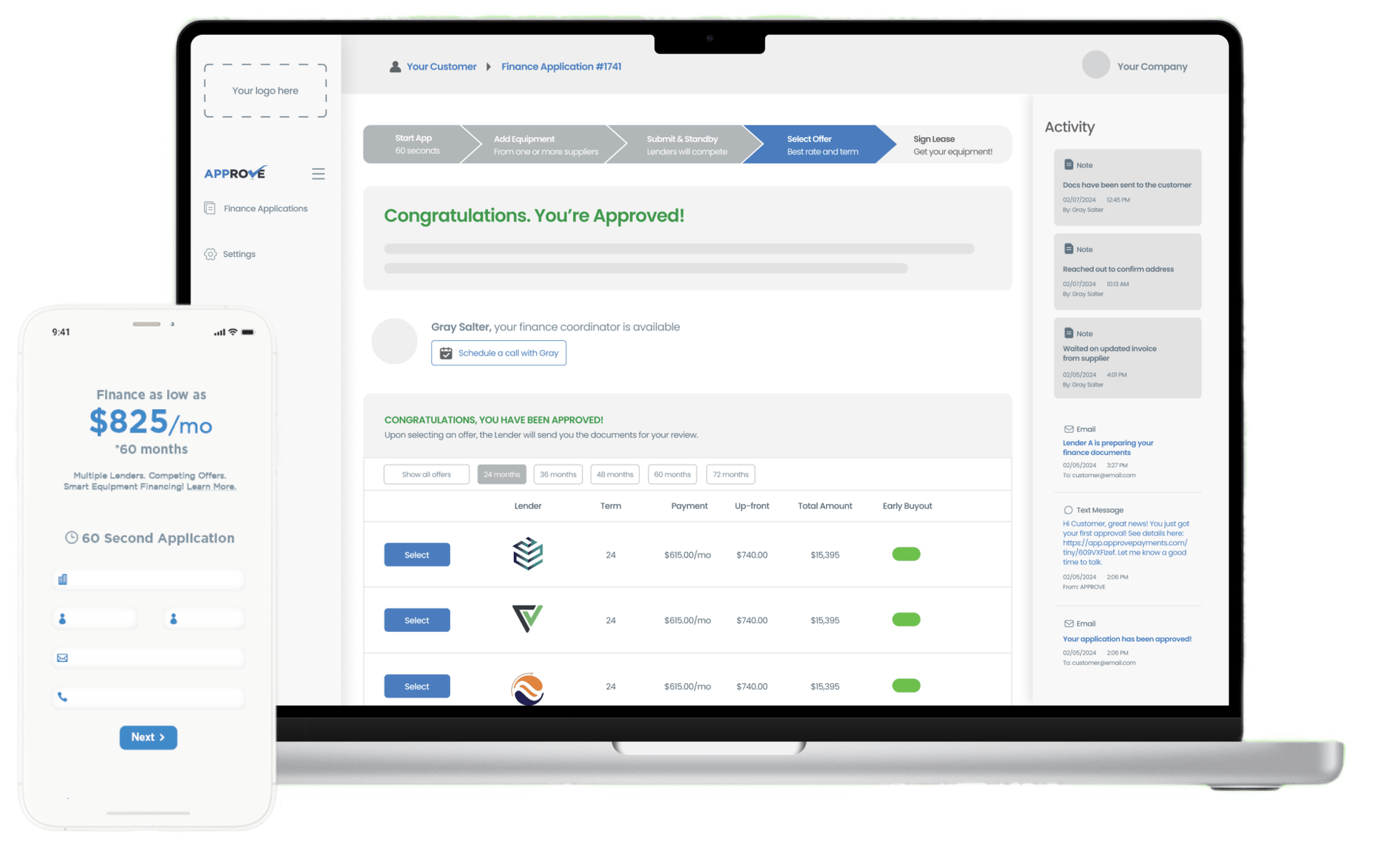

Track every deal from application to funding.

Our easy-to-use dealer portal gives your team complete insight into every buyer’s journey. See who’s approved, who’s pending, and what’s needed to close the deal — all in one place.

- Centralized tracking for all applications

- Get notifications the moment offers are ready

- Focus your team’s time where it matters most

Get support from financing experts every step of the way.

Technology can streamline financing, but it’s people who keep deals moving. That’s why every APPROVE partner gets access to a dedicated team of finance experts who work directly with your buyers and lenders to make sure nothing falls through the cracks.

We handle the details by coordinating approvals, answering buyer questions, and keeping communication clear so your team can stay focused on selling instead of chasing financing.

Our Process

STEP 1

Apply Online in 60-Seconds

Provide your information and complete our easy online application in just a minute.

STEP 2

Get Matched with the Perfect Lender

We connect you with our network of top lenders who can offer the best terms for your business.

STEP 3

Choose Terms and Get Your Equipment

Select your financing terms and start using your equipment to grow your business.

Maximize

Approval Chances

Our diverse lender network can approve applications from a far wider range of business types and credit profiles than any individual lender.

Minimize

Financing Costs

Our technology identifies those lenders in the network that are most likely to APPROVE your application and offer you the lowest finance rates.

Make Better

Informed Decisions

Complete one APPROVE application, and we’ll match you with your ideal lender. If multiple lenders fit, you’ll receive offers to compare side-by-side.

to business financing.

How can we support your business today?

|

Acquire essential business equipment while preserving cash flow. Loans have 12-72 month terms, with monthly payments often deductible as business expenses. Builds business credit.

Short term loans (6-24 months) to manage cash flow, seize growth opportunities, and cover temporary cash flow gaps.

|

|

1

Submit Application

|

2

Lenders

Compete |

3

Choose

Best Offer |

Trusted by business leaders across industry sectors.

⭐️⭐️⭐️⭐️⭐️

These guys went beyond the call of duty to help me purchase my machinery. Thank you very much A+.

Dennis D.

⭐️⭐️⭐️⭐️⭐️

Awesome service, very fast response and walked me through the whole process very fast and painless. Definitely will be doing more business in the near future.

Christopher S.

⭐️⭐️⭐️⭐️⭐️

These are some of my favorite people to work with. They are great with my customers!

Jennifer C.

to business financing.

How can we support your business today?

|

Acquire essential business equipment while preserving cash flow. Loans have 12-72 month terms, with monthly payments often deductible as business expenses. Builds business credit.

Short term loans (6-24 months) to manage cash flow, seize growth opportunities, and cover temporary cash flow gaps.

|

|

1

Submit Application

|

2

Lenders

Compete |

3

Choose

Best Offer |