Customer Success Story: Southeastern Equipment & Supply

APPROVE is a fintech company that works with equipment sellers and buyers throughout the nation to help them maximize the power of financing to grow their B2B sales. Understanding that every equipment vendor has a unique business model and sales process, APPROVE makes it a priority to deliver the individual attention each client requires. So, APPROVE’s team members aren’t just financial technology specialists—clients also look to them as partners in fueling their business growth. The philosophy is an old one, but a good one: A rising tide lifts all boats.

Southeastern Equipment & Supply Inc. values that partnership. Read on to find out how this business relationship has turned into real dollars for Southeastern—and why APPROVE also benefits.

Growing together

“APPROVE is looking to grow with us,” said Austin Ervin, sales and marketing director for Southeastern. And Ervin appreciates APPROVE’s responsiveness. “We wanted a partner who delivers on their promises and makes us feel valued.”

Headquartered in West Columbia, S.C., the Southeastern Equipment ships new and reconditioned commercial floor cleaning equipment worldwide.

The company was looking for a partner that could help connect its customers with financing. Company leaders knew that strong communication, personalized service and quick response time would be critical to making any financing solution work, and the company found all of these attributes with APPROVE’s Saas solution for equipment financing.

Now as part of the sales process, Southeastern can offer customers a seamless financing experience tailored to its buyers’ unique needs. For Southeastern, this means greater efficiency, more choices and rapid turnaround as customers’ financing applications get matched with the ideal solution from a curated network of lenders.

Open communication

Another strength of APPROVE, according to Ervin, is its ongoing requests for feedback from Southeastern and willingness to make changes in response to that feedback.

“The partnership and the communication are key for us,” said Ervin.

The company hadn’t always found that spirit of camaraderie with other lending solutions. After some disappointing experiences before APPROVE, Ervin says Southeastern decided to make a change. He explained why APPROVE works well with his business: its large network of lenders that can deliver the industries’ highest approval rates, and a willingness to work quickly to address specific needs.

Invested in client success

By looking at itself as a true partner with clients, APPROVE gets valuable feedback that has resulted in some of the latest innovations in real-time equipment financing.

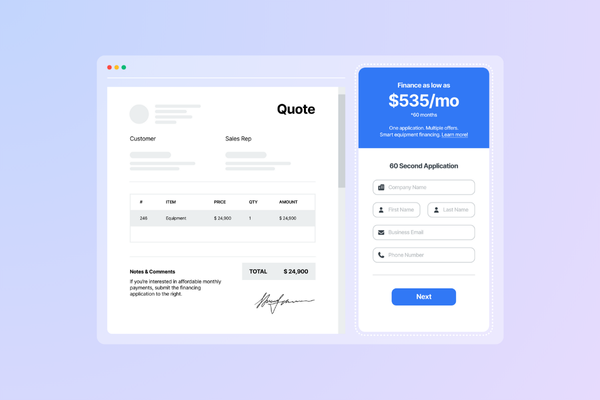

For example, APPROVE released a Google Chrome extension in April that allows equipment sellers to embed financing estimates and application links in sales quotes with just a few clicks.

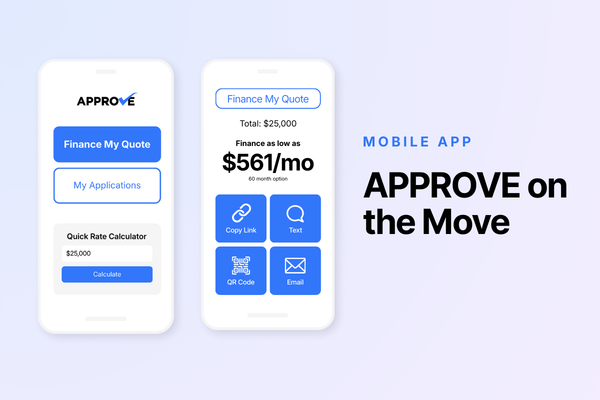

A new mobile app, “APPROVE on the Move,” allows sellers to create and share customized digital finance applications and track real-time movement on financing applications, no matter where they are.

Both are the result of listening to the people APPROVE works with and empowering the tech team to come up with creative solutions to common financing problems. You’re in good company when you work with APPROVE.